There is often a question as to how much income is reported, and more importantly, what is the available, document-able (is that a word?) income that will be available for spousal support/alimony as well as child support.

The good news is, you are a fully functioning member of your family’s Joint IRS form 1040 Tax Return. You are entitled to order a copy of your history with the IRS. You’ll have to go online to Sign Up for your own account. The reason why it’s your “own” account, is that the IRS records for everyone are based on their own, individual social security number (SSN). Think in terms of your IRA, traditional or ROTH, these accounts are individual to your name and SSN. However, all of these figures are in fact available online. Once ordered, they will mail them out to you, so allow plenty of time.

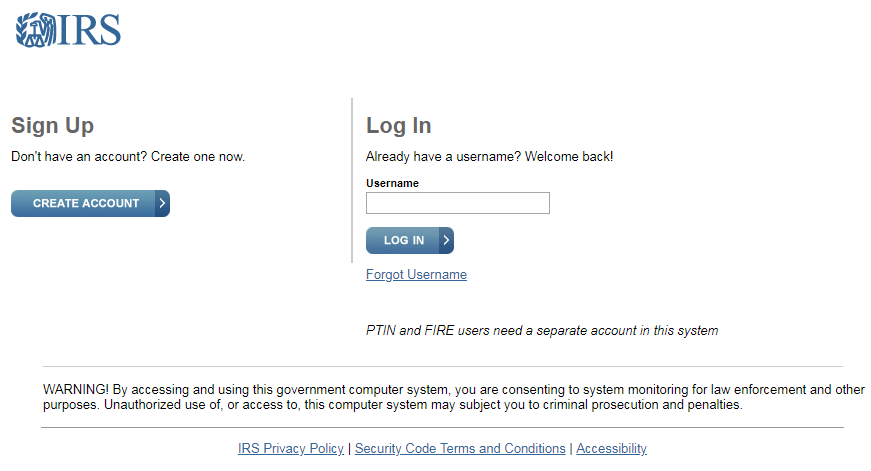

You’ll need to see these transcripts (best before you meet with your attorney) rather than waiting for a ‘non-disclosing’ spouse to provide them to you at discovery, after you’ve filed. Here is the link and a screenshot of the IRS site:

https://www.irs.gov/payments/view-your-tax-account

So, don’t be frustrated or give up if it doesn’t work the first time. Just now, I went in and tried to login to give you some additional specifics. However, even though I found the username and password in my Outlook contacts at work, I had an old username and password listed. Now I remember why, I got to this same place last time, and they then have to send you an access number by mail to your address listed. When the letter from the IRS arrived at my house, I’m certain I put it somewhere special, and have no idea where it now is. So I requested a new one.

This would be interesting to hear if any of you, dear readers, who don’t live in the former family home address (from last year’s tax return), are able to request the address for the “activation code” or if it will only be sent to your last known mailing address I think I will reach out to a client who is recently divorced. Please share your experience so that other’s might have an easier time than I did, or than you did. **I’ll update as I learn more.

Here we grow…

***Found this for calling and ordering transcripts:

To request a transcript by telephone, call the IRS at 1-800-908-9946 and follow the prompts in the recorded message. The IRS also provides a “Get Transcript” tool on its website. You can obtain an exact copy by filing Form 4506 (Request for Copy ofTax Return).

Do You Need a Copy of a Past Tax Return? – IRS.com

https://www.irs.com/articles/do-you-need-copy-past-tax-return